28+ Biweekly mortgage calculator

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners insurance and HOA fees.

10 Free Household Budget Spreadsheets Debt Snowball Spreadsheet Debt Snowball Calculator Debt Reduction

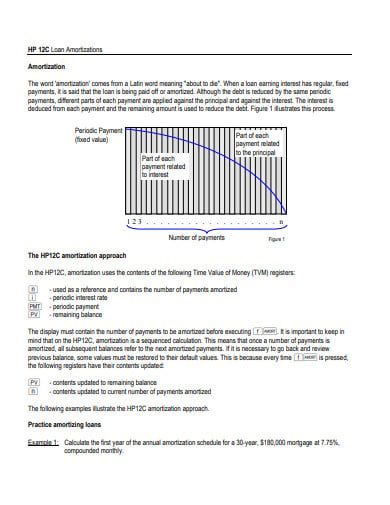

The extra payment loan calculator also has an option for biweekly payments allowing a borrower to see.

. On August 28 the IRS issued Notice 2020-65 which allowed employers to suspect witholding and paying Social Security payroll taxes for salaried employees earning under 104000 per year through the remainder of 2020. The following table compares costs between monthly mortgage. A bi-weekly payment option is a good policy if you want to pay off your mortgage loan 4-5 years earlier.

Mortgage calculator calculate the future home value and compare to the total mortgage cost. The formula to calculate this would be x a 28 100 where a is your monthly income 1260 4500 28 100. You can also add an additional payment.

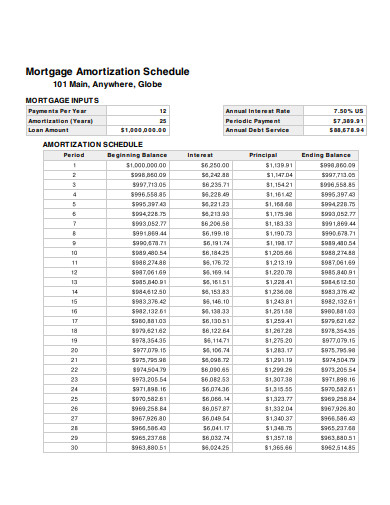

Doing so results in simple periodic interest. Also be sure to print out amortization payment schedules to keep you on track. The loan is secured on the borrowers property through a process.

You can also refinance. We used the calculator on top the determine the results. Biweekly Mortgage Calculator with Extra Payments.

Some loan programs place more emphasis on the back-end ratio than the front-end ratio. Biweekly mortgage calculator with amortization schedule is a home loan calculator to calculate biweekly payments for your mortgage. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Compounding - usually you should set the compounding frequency to be the same as the payment frequency. We also publish current Redmond conventional loan rates beneath the calculator to help you compare local offers and find a lender that fits your needs. Thus borrowers make the equivalent of 13 full monthly payments at years end or one extra month of payments every year.

And TD Bank do not allow bi-weekly mortgage payments. There are a few ways a. June 28 2022 at 1124 pm Thank you.

This entails paying half of the regular mortgage payment every two weeks. N the total number of payments. 93028 Oct 2022 92790 Nov 2022 92552 Dec 2022 92313.

The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will. Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan. Using our calculator above you can estimate the savings difference conveniently.

Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. Account for interest rates and break down payments in an easy to use amortization schedule. But before paying your mortgage loan pay off all your high-paying credit card loans.

Mortgage payoff calculator with extra principal payment Excel Template Mortgage Payoff Calculator with Extra Payment Free Excel Template Conclusion. With 52 weeks in a year. There was an ad on the bottom of the page and I didnt realize I should get rid of that.

The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. 30-Year Fixed Mortgage Principal Loan Amount. This is also calculated using the.

Across the United States 88 of home buyers finance their purchases with a mortgage. Loan amortization schedule with extra payments is a home mortgage calculator to calculate your monthly payment with multiple extra payment options. This accelerated schedule will amount to one extra mortgage payment per year and you will see how much faster you could have your loan paid off.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Another strategy for paying off the mortgage earlier involves biweekly payments. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early.

This mortgage calculator uses the most popular mortgage terms in Canada. Typically lenders cap the mortgage at 28 percent of your monthly income. The calculator supports 11 options including biweekly every other week monthly and annually.

Private mortgage insurance PMI you made a 20 down payment worth 65000. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. If youre still confused whether this payment option is best for you use the biweekly mortgage calculator above to help you see the total savings that you could be getting.

There are options to include extra payments or annual percentage increases of common mortgage-related expenses. On the other hand if you want to reduce your principal faster you can go for an accelerated biweekly payment schedule. Beneath the mortgage rate table we offer an in-depth guide comparing conforming.

Bi-Weekly Mortgage Payment Calculator Terms Definitions. Use our free mortgage calculator to estimate your monthly mortgage payments. The Freddie Mac Primary Mortgage Market Survey for October 8 2020 stated the average 30-year fixed-rate mortgage charges 287 with 08 fees points.

A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Adjustments are made for holiday and vacation days. A monthly payment is multiplied by 12 resulting in 360 payments.

For example you could make biweekly payments or one extra lump sum payment per year. If you pay for the points upfront with other closing costs and put 20 down on a home priced at the 2019 average you would need to save 76780 while obtaining a loan for 307120. Some lenders that allow biweekly payment.

Auto loan calculator calculate the total cost of ownership. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Remember to adjust the Holidays. The one-year two-year three-year four-year five-year and seven-year mortgage terms. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year.

Biweekly calculator in one schedule. The biweekly loan calculator has a biweekly amortization schedule excel that breaks down all the payment details. As originally proposed these are not forgiven payments but rather deferred payments which need to be paid in half by the end of.

Cambodia has the most days in a year in the world set aside to be non-working days as established by law at 28 followed by Sri Lanka at 25. With 52 weeks in a year this approach results in 26 half payments. Biweekly paymentsThe borrower pays half the monthly payment every two weeks.

For a biweekly payment a 30-year term is multiplied by 26 resulting in 780 payments. To show you how this works lets compare two 30-year fixed mortgages with the same variables. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

This calculator will demonstrate how making one half of your mortgage payment every two weeks can save you money in the long run. The schedule calculates payment due dates from the first payment due date.

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Free Time Card Calculator For Excel Templates Printable Free Card Templates Free Card Templates

Rule Of 78 Calculator Double Entry Bookkeeping Amortization Schedule Calculator Interest Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Here Are Five Tips To Help You End The Madness And Keep Current With Your Bi Weekly Pay Weekly Pay Monthly Bill

3 Ways To Create A Mortgage Calculator With Microsoft Excel Mortgage Repayment Calculator Mortgage Calculator Mortgage

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Excel Templates Mortgage Payment Calculator Mortgage

Simple Weekly Budget Template Beautiful 7 Bi Weekly Bud Template Weekly Budget Template Excel Budget Template Household Budget Template

Tumblr Home Equity Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

Monthly To Biweekly Loan Payment Calculator With Extra Payments Mortgage Repayment Calculator Loan Online Calculator

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Annual Budget Template Debt Snowball Calculator Personal Finance Bundle Excel Credit Card Debt Tracker Debt Snowball Debt Payoff

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Bi Weekly Amortization Schedule How To Create A Bi Weekly Amortization Schedule Download Thi Amortization Schedule Excel Calendar Template Monthly Calender

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

How Much Home Can I Afford Mortgage Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

Paying Bills Bi Weekly Using A Budgeting Spreadsheet Budget Spreadsheet Paying Bills Budgeting